COVID-19 Asia Media Impact: Learnings. A summary of economic and media implications identified

Data: 2020 m. kovo 24 d.

26th Feb 2020

Learnings From Coronavirus Impact on Media in China & Other Asian Markets

Background

The sudden outbreak of the novel coronavirus (COVID-19) in Wuhan, the capital of China’s Hubei province, in late December 2019 has sparked a health crisis with global impact. The outbreak has since led to several important markets in China being put on quarantine status, the denial of entry in a number of countries to Chinese and foreign nationals who have visited China in the past days. As we are seeing continued spread, learnings from how it has affected Asia are rapidly becoming globally relevant.

Overall Business Impact In China

Several industries are seeing the sizable impact this virus has had on the economy. Global luxury brands have seen significant declines; Burberry has had their shares gone down almost 15% with over a third of their stores shuttered. Oil prices are dropping as China’s oil demand has dropped over 20%. Travel, especially airlines and China tourism businesses, has all but dried up. The number of Chinese tourists to Macau dropped by 80% and inbound Chinese tourism has for the most part ceased, impacting economies around the world. Limited movement of people and suspension of most office-based work companies like Starbucks have also temporarily closed over half of their 4,000 outlets in Mainland China.

In order to prevent economic damage, the People’s Bank of China will inject 1.2 trillion RMB ($174 billion USD). The government is also launching a fund of 300 billion RMB ($43.5 billion USD) to help affected businesses. Despite the government’s efforts, it is likely that this will impact China’s 2020 economic growth, which was already anticipated to be a 30-year low.

Heavy Impact for Brands with Face To Face Purchase, Including QSR

Yum China has closed 30% of its stores, causing some store sales to be down 40- 50% during the otherwise popular Chinese New Year time frame. To counteract this decline, Yum Brands has launched contactless delivery which includes delivery couriers to call customer to set a delivery location and watch the order pickup from at least a 10-foot distance. Couriers are required to wear masks and disinfect their hands after each delivery. KFC and Pizza Hut have also launched contactless in-store pick up where consumers pick up their orders from a rack.

Starbucks has closed over 2,000 of their 4,000 stores in mainland China – untimely as they have embarked on a massive expansion plan to increase store counts throughout the country, leaving them more vulnerable. In December, Starbucks stated that they would be opening about one Starbucks every 15 hours in China, with the end goal of 600 new cafes planned.

As of early February, it was reported that McDonald’s has closed stores in Hebei province, was accounting to about 300 restaurants. Similar to KFC and Pizza Hut, McDonald’s has also begun contactless delivery to maintain sales while keeping health and safety a top priority. Temperature screening has also been implemented to further reassure customers around food safety (ref: image on the left corner). Some McDonald’s locations have also been reported feeding health care workers for free.

As the virus continues to proliferate, we can expect measures taken in China to be be needed in other Asian markets and potentially internationally.

We can expect similar impacts to purchasing of other products that require an in-person transaction, including car manufacturers, as well as companies dependent on China for production while factories remain closed.

Developing Impacts Outside China

The challenges in China are reverberating through the global economy. Apple and Hyundai have already signaled that disruption in global supply chains are expected to impact earnings. Meanwhile, commodity export-dependent emerging market economies are being impacted by reduced international commodity prices. This is likely to in turn trigger reduced consumer spending in these markets, on top of reduced spending due to reduced tourism and movement of the public out of fear of contracting the virus.

OMD’s POV

Behavioral shifts to expect Surveys run by our agencies in Hong Kong indicate trends that are likely to apply to elsewhere in Asia as the disease continues to spread. There, 84% of people are avoiding public places. 89% are wearing masks. 51% are avoiding travel outside HK, which will affect tourism.

Categories more affected

Travel/tourism, leisure, hospitality. Transport (due to WFH), real estate, distribution (affected by delivery staff). Luxury goods (-41% in HK MOM), Restaurants

Categories less affected

Expect gaming, insurance, beauty pharmaceuticals, supermarkets and government to be less affected. Ecommerce will likely suffer from a lack of support personnel though demand will rise.

Ad spend will likely fall

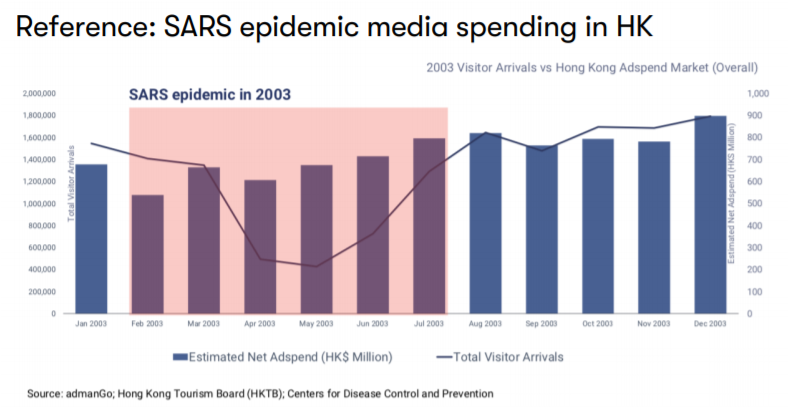

Previous experience with social unrest and SARS affected ad spend to the tune of 10- 15%; depending on total disruption and length this could be greater.

More time spent with media

In terms of short term media shifts, we expect to see a spike in media consumption across all channels, with a particular focus on escapism in network/broadcast TV (up 9% in HK) streaming and news content, as the public look for updates relevant to their situations and spend more time at home. Outdoor is likely to be less effective at this time.

CPM’s may fall

If a large number of brands pause their media due to the situation at the same time that supply goes up due to increased time spent at home and with news, we expect to see downward pressure on price.

Possible long term switch to more online shopping for basics

Changed behavior during epidemic to minimize contact may result in long term behavioral shifts.

Recommendations

Consider media adjustments

Significant numbers of people at home are leading to spikes in digital and, so far to a lesser degree, TV. Consider aligning with trusted news and related content, especially with relevant messaging.

Changes in transport and time spent outside suggest reductions in spend on outdoor, cinema and possibly radio. Be wary of appearing in inflammatory social environments.

Consider messaging

Brands in the region should be considering either pausing or switching to messaging more relevant to the situation, including emphasizing how products can be received without direct contact, or how they may help in an emergency situation, if applicable.

In China, we have seen brands looking to solve emerging needs created by the situation, including boredom, productivity and entertainment.

Consider corporate social responsibility

Brands should strongly consider corporate social responsibility initiatives to deepen relationships with consumers, reassuring and helping, enabled by media. This approach can build significant brand equity for the future, while also offering meaningful help to people in a time when they may need it a great deal.

Source: Israel Mirsky, Executive Director, Global Technology & Emerging Platforms Israel.Mirsky@omd.com